March 15, 2017

Increased US crude oil exports are positive for Aframax demand in the Caribs

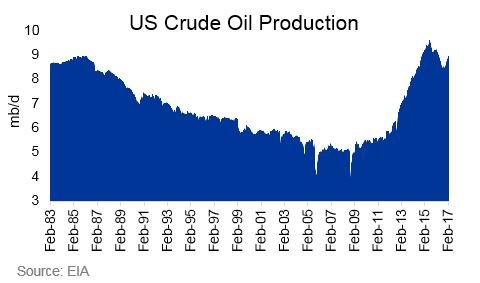

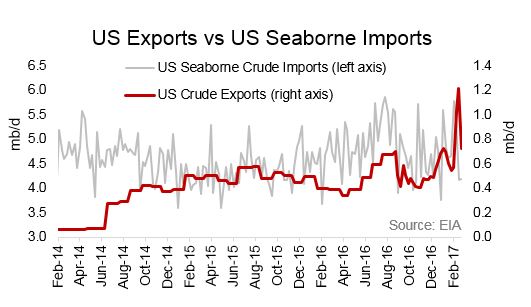

Crude oil exports from the United States reached a historic peak of 1.2 mb/d in mid-February, up from 0.6 mb/d at the at the end of January. Cargoes have moved as far as India and China in recent weeks, with some of this long haul crude moving on Aframaxes. So, what’s the deal with all of these US crude oil exports? The US Congress relaxed the long-standing ban on domestically produced crude oil exports in Dec’15, paving the way for US producers to access world markets. For most of 2016, exports were slow to ramp up, with an average of ~0.5 mb/d of domestic crude leaving the US. However, as we’ve seen in recent weeks, that volume has now more than doubled. While two dozen oil producing nations are currently grappling with production cuts in order to boost oil prices, the US is bucking that trend by ramping up production, adding more drill rigs (an addition of 73 so far this year), and building out export infrastructure. So far in 2017, production is averaging ~0.2 mb/d higher than 2016. |

|