September 6, 2016

Consolidation of Yard Capacity is Positive for the Long-term Health of Shipping

“It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change”

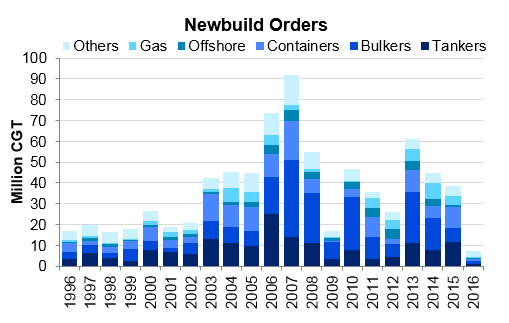

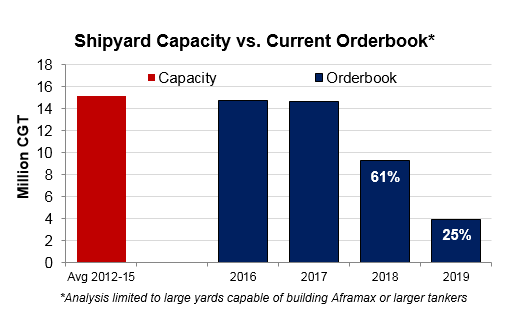

A dramatic collapse in newbuild orders due to a weak market environment across all shipping sectors is putting pressure on the global shipbuilding industry. Just 7.2 million compensated gross tones (CGT) of new orders have been placed through the first eight months of the year, by far the lowest year for new orders since at least the early 1990s, and possibly longer (accurate orderbook data is patchy pre-1996). The problem for the yards is that global shipbuilding capacity is far higher than it was in the past, at approximately 50 million CGT per year vs. 15-20 million CGT per year in the 1990s. The current lack of new orders is therefore having a greater impact on shipyards, with average contract lead times falling from around 38 months at the peak of the last shipbuilding boom in 2008 to around 23 months at the beginning of 2016. As per our estimates, the major shipyards have only filled 60% of total capacity for 2018 delivery with 25% booked for 2019. |

|